Tsunami ahead? Communications key for Insolvency Practitioners

April 30, 2021 • 4 minute read

New statistics released by the Insolvency Service have shown that corporate business failures in Q1 2021 continued on the downard curve which began with the start of lockdown and the roll out of government support measures such as furlough and CBIL, reaching an all time low for a single quarter.

Confidence is returning to the UK economy as lockdown restrictions begin to ease, but the current low rate of company insolvencies is likely to be the calm before the storm. The government support which has been a lifeline to so many companies will come to an end and there will doubtless be business casualties. The European Systemic Risk Board has warned of the risk of a ‘tsunami’ of bankruptcies when the lifeline of government support schemes is removed.

For insolvency practitioners looking ahead and anticipating a significant rise in instructions, one thing is clear. Effective communications, particularly in complex insolvency matters, will be key as practitioners seek to preserve both the brand value of the companies they are appointed to, and indeed their own professional reputations amid significant public and stakeholder scrutiny.

This high level of scrutiny should not be underestimated, and must be prepared for.

To take an example, company administrations may have fallen by more than 50% compared to Q1 2020 but they have certainly not fallen off the media agenda. Indeed, media mentions of key administration terms has stayed relatively flat across 2020 and into the first quarter of 2021.

Public awareness of insolvency has never been greater and there is intense media scrutiny over how such matters are handled.

For insolvency practitioners effective handling of the media narrative is fundamental to their fiduciary duty of securing value for creditors and minimising disruption to stakeholders – either through securing a sale of a business / its brand or through an effective wind down.

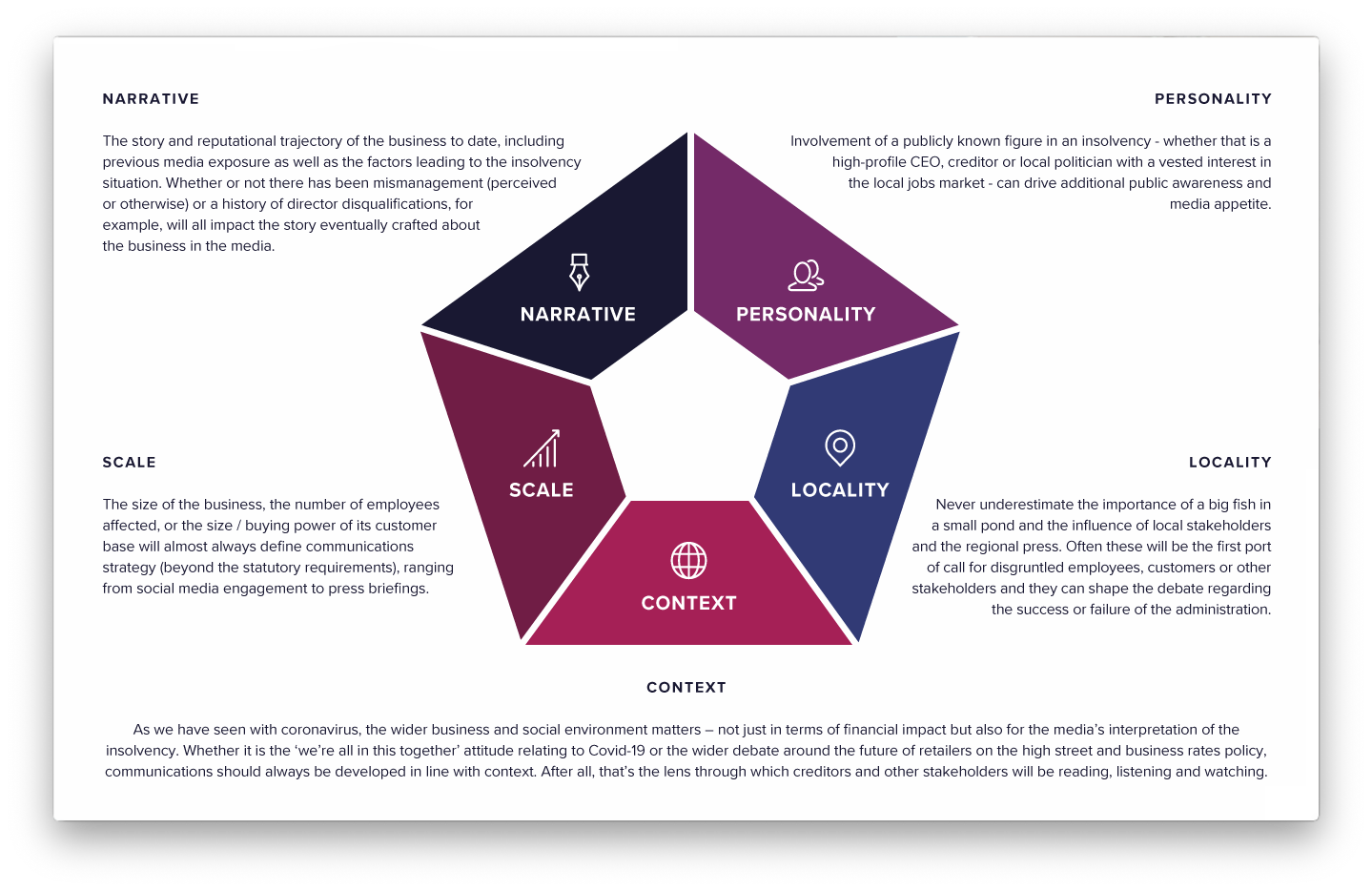

At Infinite Global we see a range of factors determine the communications landscape for insolvencies, which we define in our Reputation in Restructuring Framework.

There are certainly ingredients which mean that an insolvency will result in a PR storm, but the challenge ahead is that with public funds now inextricably bound up in so many businesses, public interest in how those businesses fare is acute.

Every pandemic-related insolvency will have a public impact and will garner a corresponding level of local, regional or national media attention. Stakeholder engagement and management has always been a core part of an insolvency practitioners work, but that stakeholder landscape is now increasingly complex and media strategy will undoubtedly be high on the minds of practitioners.

Infinite Global has advised on the communications, including creditor / stakeholder relations and media handling, of more than 130 corporate insolvencies. Find out more about our restructuring services and contact our experts here or via insolvency@infiniteglobal.com.

How can we help?

Get in touch with us or find an office close to you