Tax and reputation – Tracking a tumultuous relationship

September 16, 2020 • 10 minute read

Introduction

Taxation has always been a contentious issue. Louis XIV’s Finance Minister, Jean-Baptiste Colbert, said the art of taxation consists in so plucking the goose as to obtain the largest number of feathers with the least amount of hissing.

In today’s business world, driven by technology and globalisation, Colbert’s geese have grown far bigger wings and routinely fly further from the nest. But as the financial footprints of multinational organisations and prominent HNWIs transcend national boundaries more than ever, the art of taxation has become ever trickier.

Against this backdrop, corporate and individual taxpayers must tread carefully, protecting their feathers while meeting not only their fiscal obligations, but increasingly their reputational (and arguably moral) responsibilities also.

Look back at recent years to see how once strong reputations have been questioned, challenged and damaged by the adoption of tax strategies that, while within the law, have contravened stakeholder expectations and generated significant negative media attention.

Understanding the relationship between tax strategy and reputation is therefore of critical importance for corporates and individuals alike, not least those in consumer-facing industries where the impact of negative publicity can be felt most keenly.

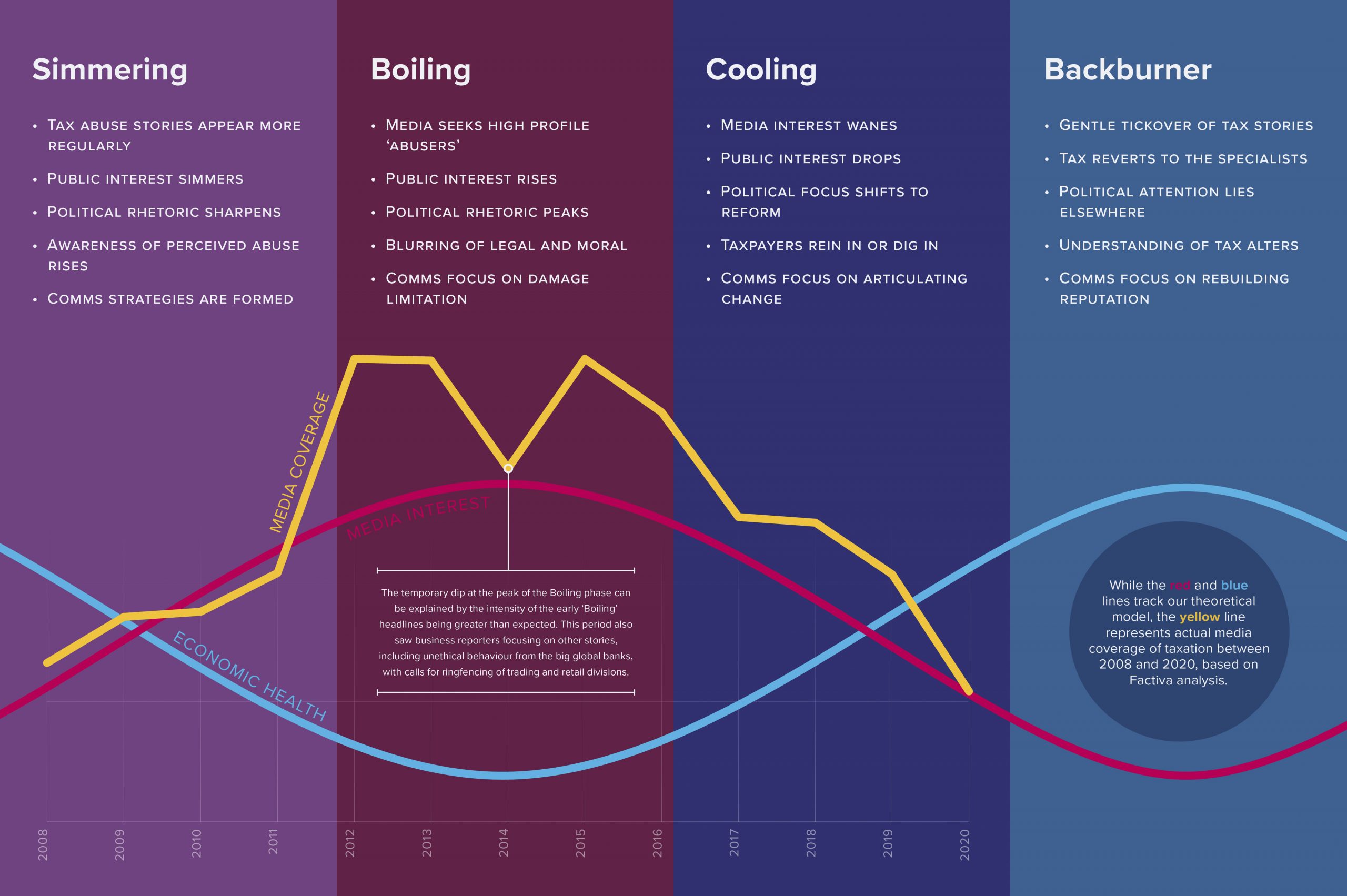

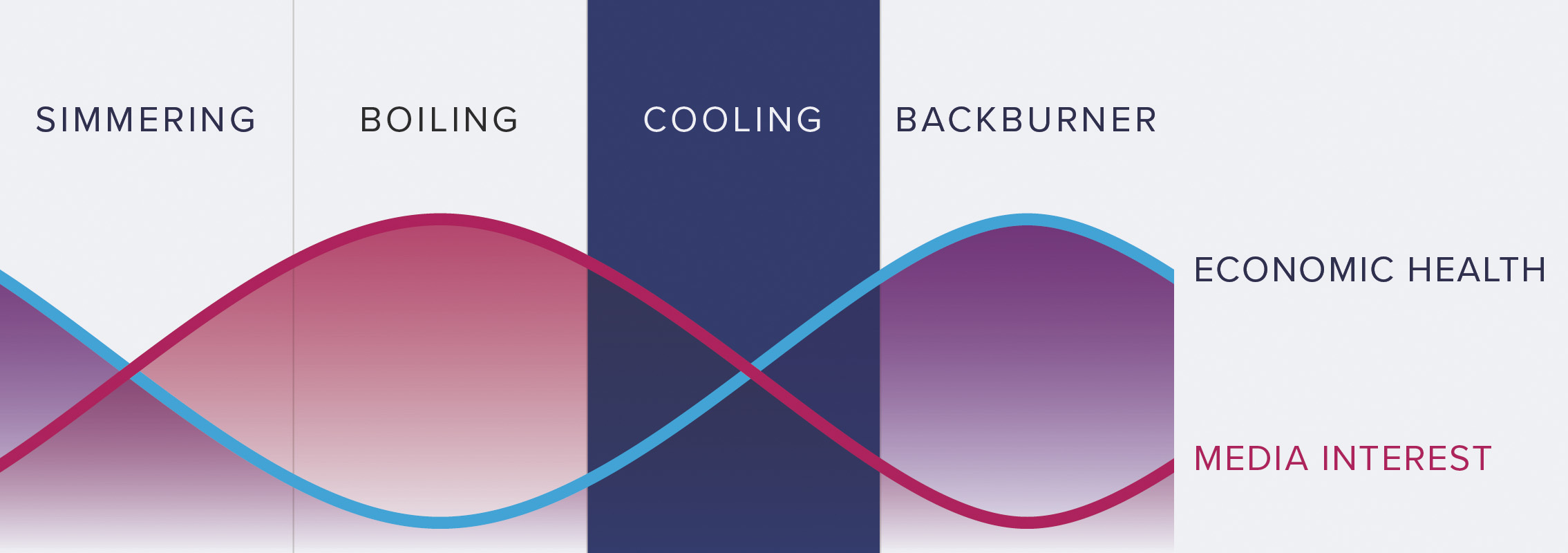

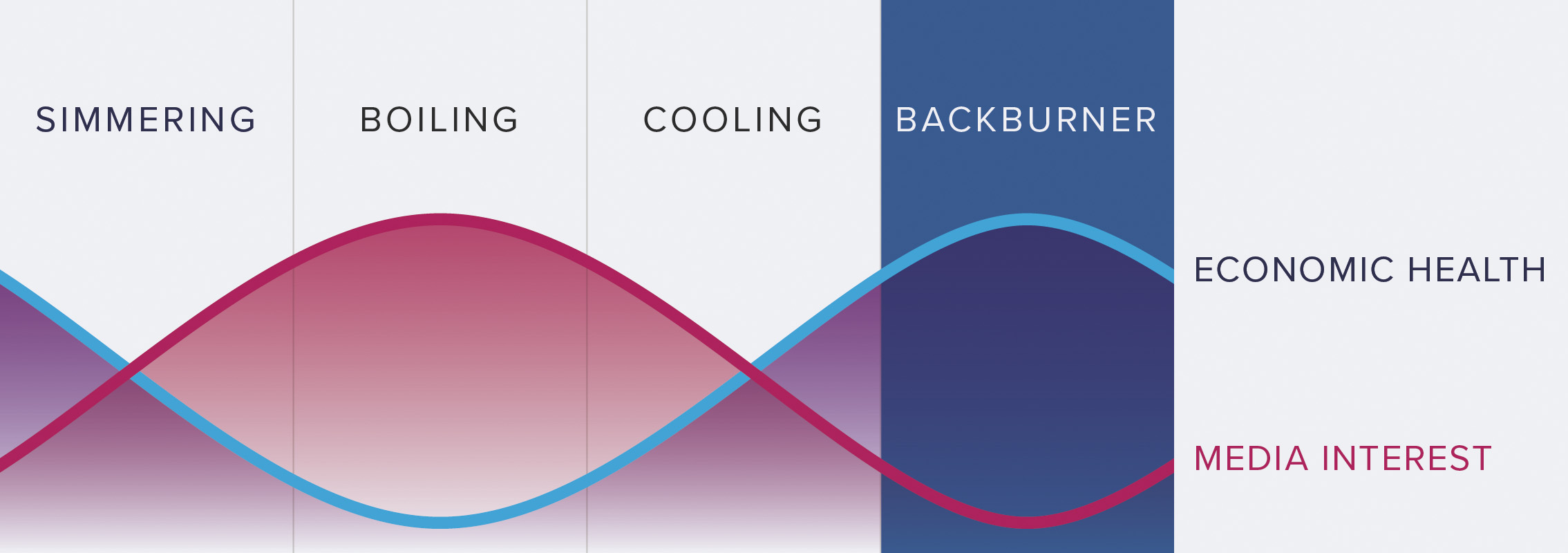

Infinite Global undertook research to better understand this relationship. Our analysis reveals that media reporting of stakeholder attitudes towards corporate and individual tax strategies is fluid, not fixed. We found that the tone and focus of media coverage of taxation issues shifts over time and correlates broadly with the traditional model for an economic cycle.

The outcome is clear: if media and stakeholder sentiment towards issues can be better predicted, then taxation and reputation management strategies can be better managed.

Our research and methodology

Infinite Global undertook research to better understand the changing nature of media and stakeholder attitudes towards corporate and individual tax activities.

We analysed media coverage of tax issues by major UK business news outlets between 2008 and 2020, evaluating the specific focus, tone and sentiment of the reporting. Throughout 2018 and 2019 we also interviewed some of the UK’s leading tax and accounting journalists, to understand their editorial perspective on how they report tax issues and the extent to which this may or may not change over time. We then mapped our data onto a timeline, to provide a framework for review.

A clear picture emerges, from which we have developed a four-phase model designed to help organisations and individuals alike understand better the evolving risk of negative media attention and thus the interplay between tax strategy and reputation management.

Our findings

Our analysis reveals three key findings:

- Media and stakeholder interest in taxation rises and falls in tandem with the economic health of a nation. In boom times, scrutiny of tax affairs is lower; in times of bust, interest peaks.

- There are four clear phases of scrutiny on tax affairs, which we have termed Simmering, Boiling, Cooling, and Backburner.

- Corporate and HNWI taxpayers are advised to monitor the evolution of these four phases, tailoring their tax strategies – and communication of these strategies – accordingly. Failing to do so may have severe implications for reputation management.

Our model

Our model identifies four distinct phases that comprise the tax-and-reputation cycle, each with differing characteristics of media and stakeholder interest. Importantly, the four phases – Simmering, Boiling, Cooling, Backburner – correspond broadly with the four stages of the traditional economic cycle: Recession, Recovery, Upward Growth, Downward Growth/Downturn. As the cycle of economic growth and decline rolls forward, public attention paid towards the tax affairs of businesses and the wealthy fluctuates.

Phase 1 in our cycle is the Simmering phase. Simmering occurs during a period of economic downturn and is characterised by a shifting of the tax-and-reputation debate into the periphery of public awareness. At this stage, stories in the media focus typically on an individual company or person’s perceived taxation misdeeds; the media is not yet joining the stories together to raise concerns about systemic abuse.

Phase 2 in the cycle is termed ‘Boiling’. The intensity of the focus on tax as a public interest item rises. Those in the spotlight really feel the heat. The stories in the media build upon each other with editorial commentators making links between them. Journalists are on the lookout for new examples and their editors are keen to run them prominently. Politicians stir the pot and heat rises further. Populism and aggressive rhetoric are by this point in full swing, becoming key weapons in this debate.

We have labelled Phase 3 in the cycle ‘Cooling’. Public interest wanes. Ever more sensational angles, or egregious cases of perceived abuse are required for tax stories to attract editor’s interest so they appear less frequently.

For those that had the lion’s share of the negative attention, the promises made around changing strategies under the heat of the Boiling phase may start to be implemented. Others may fight back and attempt to shift the blame from what they deem to have been unfair scapegoating.

In Phase 4, the cycle goes on the ‘Backburner’. Tax stories almost run dry and the media and politicians find other concerns to occupy them. Taxation returns to the preserve of the technical specialists. But this is likely to be merely an intermission. At some unscheduled moment, an incendiary news hook will bring tax avoidance back to the fore and spark a new Simmering phase. As the heat begins to rise again, the debate will be starting from a different point, with embedded public awareness advanced by the previous cycle.

Over the coming pages, we look in more detail at each individual phase, its characteristics and the type (and examples) of media reporting that defines each point in the tax-and-reputation cycle. Importantly, we highlight the pertinent reputation, PR and brand management lessons that organisations ought to consider at each stage.

Where are we today?

While this research was conducted prior to the onset of Covid-19, the model allows for external forces and factors impacting the economy to be taken into account – the pace of transition from one phase to another will simply be altered.

As we approach the final quarter of 2020, we find ourselves between the Simmering and Boiling phases. The impact of coronavirus and lockdown on employment, consumer spending and confidence has accelerated the expected economic downturn. The arrival of this recessionary period will likely see a renewed public and media scrutiny of corporate behaviour and this will be accompanied by changing attitudes to wealth and the wealthy.

Taxation plays a key role during this phase: the tax gap still exists, while the government needs to bolster a depleted treasury in the wake of huge redirection of public resource to help navigate the impact of the pandemic. Vast public spending and a clear strategy from government to review the tax system as it seeks to claw back investment could lead to the imposition of new wealth tax measures and, at the very least, a heightened interest in concepts such as ‘paying a fair share’.

Displays of wealth will not be well-received, so communications policies must not be tone deaf to what is going on in the wider world, while there will be particular scrutiny of businesses and individuals perceived to have abused public funds received, for example through furlough and government loan schemes.

Whichever way we slice it, tax will be part of the solution on the road to economic recovery. Corporate taxpayers and wealthy individuals should prepare for a carrot and stick approach, characterised by punitive measures being imposed for non-compliance or abuse, and targeted incentives to stimulate economic activity. At this point, taxpayers must listen to their stakeholders and monitor patterns in media reporting. As political rhetoric sharpens, communications strategies will start to be formed, and tax structuring approaches will be reviewed in light of this and in response to potential new measures.

Given the severity of the economic impact of Covid-19, policy changes may be both swift and numerous. Close attention should be paid by all.

‘Simmering’

Taxation is, at the start of this cycle, largely the preserve of technical experts. Public interest in corporate or individuals’ tax affairs is low. Tax minimisation strategies are commonplace but few attract meaningful attention; they are considered only as part of the routine functioning of business affairs.

However, as the economy falters, the strain on government budgets causes greater concern from politicians and the public about tax avoidance and fairness.

As a response, tax authority aggression starts to rise in parallel with stricter enforcement and populist tactics. Political rhetoric sharpens, invoking more emotive and provocative language against rule-breakers and rule benders. The tone becomes more aggressive and public interest begins to simmer.

- Tax abuse stories appear more regularly in the media

- Public interest begins to simmer

- Political rhetoric sharpens

- Awareness of perceived abuse rises; understanding lags behind

- Communications strategies must start to be formed

Media analysis

Media reportage will, at this stage, highlight inequality. The backdrop of austerity provides room for contrasts to be drawn out – stories of corporate excess, or corner cutting on taxation, resonate with a public that is feeling the squeeze.

In March 2009, The Sunday Times ran a story ‘The banker, his socialist wife and the billion-pound tax question’. The piece began: “As recession scythed through Britain last month, the wife of a senior Barclays banker held a lavish party at the five-star Peninsula Hotel in Los Angeles.”

Such stories place high-profile celebrity attendees front-and-centre to spark audience interest, using the juxtaposition of rampant recession and lavish excess to emphasise a sense of inequity.

Bankers and ‘City folk’ are a regular target for populist attack and it is to be expected that such stories find traction. Similarly, Goldman Sachs found itself on the front pages when details of its tax avoidance practices – and subsequent ‘sweetheart’ deal with UK tax authorities – emerged as a result of whistleblowing. This initial spark ignites the ‘Simmering’ stage of the cycle.

The language used by the media undoubtedly influences the debate. ‘Sweetheart’ deals conjure images of cosy conspiracy and preferential treatment, emphasizing inequality and bringing concern for ‘fairness’ to the fore.

Infinite insight

The most important proactive communications work must be done during the Simmering phase. Misunderstanding and misconception abound. Though there is a difference between real abuse and the perception of abuse, both are very real threats. Taxation is a technical topic and complexity compounds confusion, tempting many to avoid confronting the issue head-on.

However, those that sit tight and wait run the risk of misconceptions becoming deeply ingrained in the mind of the public by the time they decide to act to try and counter the damage sustained.

Proactivity varies in importance according to the nature of the business, with consumer brands typically held to higher standards. Media outlets’ editorial strategy quickly adapts, with journalists particularly seeking stories that spotlight companies or individuals well-known to the public. B2B entities (especially those outside financial services) are slightly more shielded, as their stakeholders may be more understanding of their situation.

“A lot depends on how you explain things,” says FT journalist Vanessa Houlder. “Being proactive, providing easy-to-understand explanations in a short statement tends to produce a very short story – and not necessarily a negative one. If you have a very clear statement that nothing dodgy is going on, the story just dies.”

- Staying silent allows misconceptions to take hold

- Don’t bury your head. The problem is here – whether you think you deserve scrutiny or not

- Control the narrative; don’t allow perception to marginalise reality

- Listen to your audience and stakeholders

- Appreciate that authority aggression and political sentiment will sharpen further from this point

‘Boiling’

Multinational companies and wealthy individuals are actively targeted during the ‘Boiling’ phase. Political attention intensifies and public interest surges as rhetoric sharpens further. There is a high risk of proliferating misconceptions as technical issues are taken into the wider public sphere.

Media interest is sustained, as scapegoats are turned into case studies, with journalists publishing multiple articles around the same taxpayer as a story evolves. Reactive communications work begins. Taxpayers in the spotlight scramble to limit reputational damage.

- Media actively seeks examples of abuse by high profile and celebrity taxpayers

- Public interest peaks

- Political rhetoric peaks; scapegoating is common

- Blurring of lines between legal and moral concerns

- Communications focuses on damage limitation

Media analysis

By this stage, the issue is in full focus. Public figures seek to leverage the issue for political gain. With political rhetoric peaking, the media has no shortage of storylines. Language toughens and headlines become more emotive.

Statements from leaders, such as then Chancellor George Osborne describing certain tax approaches as “morally repugnant”, stoke the fire further. Media and public are emboldened and, buoyed by the elevation of the issue into parliamentary discussion, take more impactful action. Scapegoats are picked out. In our cycle, this stage was characterised by attacks on companies like Barclays, Amazon and Starbucks – with in-store protests occurring and social media users rallying together around these businesses as the faces of tax abuse.

Infinite insight

The ‘Boiling’ phase is the most intense stage of the cycle. The spotlight is firmly fixed on tax and the most direct reputational threats emerge in this phase.

Some taxpayers will seek to convey a simple message: ‘we take our tax obligations very seriously and abide by the letter of the law in all jurisdictions in which we operate’. Though this approach will work for some, it will prove insufficient for others.

Those in the spotlight must decide whether to quietly maintain the message that they have done nothing illegal, seek to deflect attention by offering explanations and concessions, or go on the front foot by launching a robust defence of their actions. Cases must be treated on their individual merits: the appropriate messaging and communication strategy for a showbusiness celebrity is unlikely to suit a multinational corporate.

For individuals, the story often takes less time to run out of steam.

“You’re just one individual and, if you don’t comment on it [in a manner that fans the flames of the story] the agenda shifts on. Hacks will get a bit tired of it,” says a national newspaper journalist covering the legal sector.

For corporates, this can be a tough call to make. There are more moving parts involved. Corporate identity, consumer-facing brand(s), employees (especially senior executives), third-party advisors, investors and shareholders all play a role. With more actors, it is easier for an organisation to fall victim to accusations of inconsistency or hypocrisy.

Nebulous concepts come into play and – as the pendulum of populism swings – taxpayers have to go above-and beyond to satisfy the baying masses. ‘Tax fairness’ and ‘tax morality’ are not defined in black and white legal terms, but are held up as yardsticks nonetheless. These concepts serve to further increase public anger. Companies must be seen to have a moral conscience and to value corporate social responsibility.

By the time the Boiling phase is upon us, it is too late merely to engage in reactive communications work. A strategy should be set out ahead of time and communicated in a digestible way to all sections of the business and stakeholders.

The C-suite must balance tax reporting and payment obligations with the duty to stakeholders to legally manage liabilities and protect the bottom line. Smart taxpayers fulfil tax duties while avoiding aggressive measures which could land them in trouble with the court of public opinion.

Acknowledge the spirit of the law, not just the letter. Explain why your tax strategy is justifiable or, if it isn’t, fix it.

Sensible communication and disclosure is key. Remain mindful of the zeitgeist. Take the political and social temperature and acknowledge the Boiling phase. Disclosure has more than one audience, so consider not only what is being shared, but with whom. Complex financial information may be misinterpreted by non-specialist masses, so comms must focus on explaining your tax position in a jargon-free manner.

To mitigate misunderstanding, segment your audiences and tailor your messaging. Speak in clear terms. Avoid jargon. Be proactive and open. Be reachable. Where possible, get out in front of the issues and do not bury your head in the sand.

“For those that think they may be misunderstood: well, make sure you explain yourselves!” says Houlder. “And do it in a way your grandmother could understand. It takes a bit of space, but I think it’s worth doing.”

- Segment your audiences

- Get out in front of the issues

- Acknowledge the zeitgeist and the gap between letter and spirit of law

- Explain why your tax position is justifiable, or fix it if it isn’t

- Stay calm and respond sensibly; the pressure will cool

‘Cooling’

The media spotlight on tax diminishes, but certain high-profile cases retain some traction. If there is a shortage of distractive news items, the spotlight could easily return. While an economic recovery may help to move the spotlight away, the anger that epitomised the ‘Boiling’ phase is still fresh in the public’s mind and a return to this phase could easily occur.

We witness those maligned in the media beginning to change tax strategies and practices. For corporates, this means boardroom-level oversight of tax affairs. For individuals, it involves attempting to regularise assets and bolster compliance. Some victims of scapegoating push back and try to shift blame to lawmakers. Reputational hits continue, but become less frequent and less prominent.

- Media and public interest wanes except for high profile cases; other items disrupt news agenda

- Political focus shifts to legislative reform; lobbying activities intensify

- Taxpayers pursue more conservative strategies

- Some of those attacked push back and/or look to shift blame

- Comms focus on lobbying or on delivery of practices promised during Boiling

Media analysis

‘Aggressive tax avoidance troubles large investors’, an FT story told us in November 2014, explaining that while there were short-term gains to be made through aggressive tax techniques, large investors had grown increasingly sensitive to the risks of backing companies engaged in tax planning that verges on being aggressive. The reputational damage and subsequent scrutiny from customers, governments and regulators is deemed not a worthwhile trade-off for marginal tax savings.

Two years on from that story, the FT ran the more emphatic headline ‘Tax avoidance out of favour with big business’. At this stage, the heat applied to taxpayers during the Boiling phase is still fresh in the mind, so strategies tend to err on the side of conservatism.

Reformative action continues, but is targeted at specific legal provisions. In need of ‘quick wins’ to follow through on promises of regulatory rigour, legislators and authorities seek to fix the most obvious areas deemed open to abuse.

Comprehensive legal overhaul is not pursued, but efforts may be made to promote the issue internationally, so as to tackle cross-border tax issues without placing an individual jurisdiction at a competitive disadvantage.

Most taxpayers accept that the line between legal and acceptable tax planning has blurred. Others remain convinced that they have done nothing wrong, and opt to dig in their heels. ‘Tim Cook calls notion of Apple avoiding US taxes political crap’ was a Guardian headline from December 2015. This shows the pendulum swing that occurs during Cooling. Over-enforcement, onerous compliance changes and disproportionately punitive measures can lead to an anti-transparency backlash.

Those accused of avoidance practices are, after all, not breaking the law. Pushback can be an effective ploy. Politicians realise they cannot go too far in vilifying aggressive tax practices without risk of damaging their country’s attractiveness for foreign investment. With one eye on national competitiveness and having a business-friendly regime, they row back from the barbed remarks seen during Boiling.

Infinite insight

Reputational damage is, for the most part, limited. We could find no truly ‘fatal’ examples or case studies during our research. Extreme examples such as Starbucks – which felt the brunt of political and public anger, through boycotts and sit-in protests – show that a temporary financial blow occurs before a steady return to previous levels of growth and profitability. While other, intangible factors – such as the impact on staff morale inflicted by in-store protesting – are difficult to assess, recovery is achievable if a sound communications plan is in place.

This third phase of our cycle may be the Cooling phase, where the heat is off, but the contents are still hot. A fresh angle that capitalises on public feelings of discontent that linger from the Boiling phase can provide the gas injection necessary to propel the debate back to boiling point. Here, a single person or business could find itself the centre of a new story pinned off the back of the failure of attempted reformative action. ‘As HSBC shows, we’ve been timid and pathetic in dealing with tax dodgers’ cried a Guardian headline from February 2015.

- Use the cooler environment to implement a long-term strategy and consider how to communicate this

- Continue to be proactive. Deliver on remorsefulness or explain your defence clearly

- Focus on accuracy and champion legislative reform.

- Cooler temperatures mean a more sympathetic and understanding audience whose anger can be redirected

- Don’t get complacent – not necessarily ‘out of the woods’ yet

- Engage in attempts to reform the landscape; focus on industry practices, not just your own business

‘Backburner’

As the economy stabilises, tax issues fade from the public and media agenda, ousted from the front pages by fresh news stories that capture the public attention. Story stagnation occurs if there are insufficient hooks or developments to carry the news forward and public fatigue over tax affairs sets in. We witness a return to taxation being the preserve of the specialists. However, there is a discernible shift in the debate, particularly in the media and the public’s understanding of the issues.

- Gentle tickover of tax stories in the media but more tempered treatment

- Taxation returns to the preserve of specialists

- Political attention lies elsewhere, for now…

- Public and media understanding of tax issues is permanently altered

- Comms focus on rebuilding trust and reputations

Media analysis

All news stories eventually lose steam, but it is difficult to predict accurately the point at which this is going to happen. The inflection point usually comes in the form of another story and people are left with a less heated attitude to yesterday’s news.

“There comes a point when people are no longer interested and feel saturated by a particular story,” explains Houlder.

Sometimes the distractive story is completely new and separate (a major economic or political event like Brexit or a general election, either here or overseas) and other times the focus shifts only slightly, to related themes.

We may witness, for instance, a shift of the interest in corporate financial affairs, with tax minimisation being supplanted by a media focus on executive remuneration or industry oligopolies.

There are myriad reasons for a gentle tick-over of stories around tax and reputation. Activists typically serve to elongate the debate – their continued focus on an issue means it takes longer to drift to Backburner phase. Aside from lobbying for reform, they work in tandem with the media to highlight abuse and form another pillar of accountability.

LuxLeaks, Panama Papers, Paradise Papers all fanned the flames and added fresh heat to the story during the research period covered here.

While the anger stoked up within the public-at-large may be subdued by this stage, it has not gone away. At the heart of this lies an ethical issue. Statements from national leaders have made the links between tax and morality – between finance and fairness – inextricable.

Once the issue has been polemicised (whether to pressurise for reform, protect business interests or as a policy differentiator) and emotion has been stirred up, certain groups find it hard to let go.

Infinite Insight

Subsequent government action – or lack thereof – indicates whether the rhetoric of earlier stages was meaningful or merely lip service. Lengthy consultation periods are typically needed before reform is enacted, and this delay often means that sufficient time has passed for an economic upturn to occur. In that scenario, public interest will have dropped, and tax reform can be softened or quietly kicked into the long grass.

Monitoring ‘mood’ will be essential in guiding your communications strategy. Even where corporates have not broken the law, the perception of wrongdoing – or of aggressively stretching the boundaries of acceptability – can linger, damagingly.

Even if tax minimisation strategies are legally on a firm footing, the drip-drip effect that a sustained media focus can have on public opinion means that entities should always remain vigilant.

While other news stories will oust tax and reputation from the front pages, the cycle will inevitably continue to turn. Pushback from scapegoats may have been effective in removing the spotlight for now, but the heat will return either with the next economic downturn or the next time an ambitious politician needs a populist cause. Proactivity in monitoring sentiment is important.

As the cycle continues, heat is likely to return without warning. The spotlight will be aimed at an unprepared victim’ and the first incendiary story will set the tone for the type of coverage that follows. If this first victim is unprepared and lacks a strategy, it may become synonymous with the issue in the public’s eyes.

The ‘Google Tax’ or ‘Amazon Tax’ – monikers given to the UK’s diverted profits tax – show that politicians can exacerbate this by deliberately explaining policy clampdowns in terms of a specific company’s actions.

The public will often latch onto the entity first identified in the original news story, and media reports will frequently include call-back references. This means the heat stays on certain companies, as they become attached to the issue at hand.

Despite the lack of evidence for long-term financial injury, reputational damage can stymie planned initiatives and requires a redirection of resources. In response to being thrust into the heart of the Boiling stage in 2012, Starbucks made a voluntary one-off tax payment of £20 million. Small beer for a huge multinational corporation, but not every business is in a position to set aside budget to deal with brand damage limitation.

- Anticipate a return to Simmering

- Monitor public sentiment to guide your comms approach

- Monitor economic and political signals

- Monitor media signals

- Support continued industry reform

The view from Westminster

As our report shows, politics plays a huge role in this debate. From policymaking to policing of enforcement and protecting public interest by holding errant taxpayers to account, politicians lie at the heart of this discussion. Two politicians at the forefront of this debate during our research period were Dame Margaret Hodge MP and Stephen McPartland MP.

Hodge has been Labour MP for Barking since 1994, while she also served as the Public Accounts Committee Chair from 2010 to 2015. Her tenure at the helm of the PAC spending watchdog was characterised by a strong focus on corporate tax avoidance and evasion, as she sought to hold multinational companies and UK tax authorities to account. McPartland has been the Conservative MP for Stevenage since 2010 and led the FTSE 100 Tax Challenge as part of his vocal support for country-by-country reporting as a mechanism for greater corporate tax transparency.

Substantial change

Both Hodge and McPartland agree that this debate has shifted dramatically during their time in office. “The link between tax and reputation has changed substantially during my time as an MP,” says Hodge, while McPartland notes that “it was never really a domestic issue when I was first elected”.

However, their views on our research into how this is tied to the economic cycle do not necessarily align.

“We started campaigning during a period of recession. That’s when this gathered pace,” concedes Hodge. “But I’m not sure it will suddenly disappear if there’s an economic boom tomorrow.”

Hodge acknowledges the rise and fall of media reporting that our report outlines, particularly around a recession, but does not see an explicit link between tax scrutiny and the health of the economy beyond that.

“I don’t know if there’s evidence that it’s tied to the economic cycle. You may have a spate of stories about tax, but then it goes away for a bit because people get bored and have heard lots of stories. But it comes back again, wherever we are in the cycle,” says Hodge. “In the wake of recession and austerity, it became an important issue. But if we go to a boom period, that won’t shuttle this away.”

McPartland says the strength of the economy as it was recovering actually helped highlight the issue. “People understood you could not have great public services without a strong economy and everyone contributing through the tax they paid.”

What makes a story?

As well as the shift in how closely tax and reputation are connected, both MPs have noticed a shift in how the media has treated, driven, and reacted to, these trends.

“It’s a strange mix that drives the media,” says Hodge. “It hinges on the strength of the story and what else is around in the news on that day. You’ve got to have a good story hitting at a time when nothing else is around.”

McPartland acknowledges the age-old news values and media desire for high profile, recognisable names. This is no different when it comes to tax and reputation stories.

“The media likes to focus on specific issues, often around big brands and celebrities,” he says.

As our cycle shows, the initial ‘spark’ of one incendiary article focusing on one or two taxpayers is the first sign of greater scrutiny to come for others.

“This all started with Goldman Sachs and a sweetheart deal with HMRC,” Hodge says. “That wasn’t a massive amount, but then you get Google avoiding huge amounts of taxes.”

The element of hypocrisy adds fuel to the media fire. “For someone like Bono, it was a bit more embarrassing, having built a reputation for all-around giving. It gives off an impression of ‘do as I say not as I do’. Hypocrisy is probably a big thing in making a story bigger news.”

But Hodge feels the influence of pre-existing reputation only goes so far in dictating media coverage.

“If somebody’s done something shocking, they’ve done something shocking – regardless of what you thought of them before. The facts of the case, the timing and context all drive how big the story will be,” she says.

Raw nerve

Media focus has helped to put this topic firmly on the agenda for the foreseeable future.

“When a spotlight was shone on this, it touched a raw nerve with the ordinary public, the vast majority of whom pay their tax unquestioningly, without the potential for any loophole,” says Hodge.

This elevation of the debate into the public sphere cannot be reversed. While our model shows the peaks and troughs in the scrutiny cycle, and maps changes in public perceptions and understanding, this elevation of the discussion provides a new platform of heightened relationship between tax and reputation evolves, rather than simply revolving.

“The lid is now off. You can’t turn the clock back on that or put the genie back in the bottle,” says Hodge, who points to the combined work of the public, media and politicians in taking tax stories from the Business Pages to the Front Pages.

“I often say it used to be seen to be cool to avoid tax, but we’ve turned that around through a combination of civil society, media and political efforts,” she adds. “Reputationally – whether it’s hit their bottom line or not – it does impact them.”

Reputation management in a transparent future

As the cycle continues, it is clear that transparency demands on taxpayers will continue to increase. Given the complex nature of taxation, increased transparency means increased scrutiny and therefore increased risk of reputational damage. Hodge’s advice to taxpayers is to therefore communicate the tax position in as simple a way as possible.

“The onus is on taxpayers to be transparent and to communicate effectively with their audiences. Transparency is hugely important,” says Hodge. “Ultimately, it should be very simple: don’t create financial structures that have no other purpose than to avoid tax. In the end, transparency will only deepen and the reputational hit of those who act improperly will grow.”

When does tax dodging get dodgy?

In February 2019, Sam Brodbeck, Personal Finance Editor at The Telegraph, ran the intriguingly headlined story ‘I’m a tax dodger and you should be, too’. This was a clear example of the shift in media focus that occurs during the Backburner stage of our cycle.

Brodbeck begins with an admission of ‘guilt’, before levelling the same accusation at his readers.

“I confess – I am a tax dodger. As, I assume are you, given that it’s likely you have private pension savings, Isas and other tax-incentivised homes for your wealth.”

Clearly, not all forms of tax avoidance are born equal. Brodbeck points out that workers being paid via a salary sacrifice mechanism – whereby (taxable) wages are reduced to reflect benefits like company cars and cycle-to work schemes – are, by definition, avoiding tax.

“The result is that you and your employer are cold-blooded tax cheats, deliberately paying less National Insurance,” Brodbeck explains. “Everyone accepts this, even though it deprives the taxman of funds for the NHS, state pension and other benefits.”

“But while some ways to cut tax bills are popular and widely accepted, other perfectly legal avenues are not, according to new figures from HMRC [with trusts and estates falling by a third in just over a decade due to being drawn into the group of perceived abuses – or at least attempts to disguise assets].”

In a nutshell, there’s a difference between buying cigarettes at the airport and industrial scale tax avoidance. Regardless of whether scale should be such a distinguisher, our analysis shows that there is ‘a line’. It is never clear exactly where that line lies, but our cycle shows that the line moves in tandem with the zeitgeist.

Trusts, Brodbeck notes, have been used for hundreds of years to pass on family assets – but are now being shunned because of the potential perception that this is akin to complex offshore structuring arrangements.

Complex doesn’t mean dodgy, but there is a comms point to be made, here. If an arrangement appears to be more complex than necessary, scrutiny will be applied with a sceptical, sideways slant. An inability to set out, in simple terms, the reasons for a structure will lead to a presumption of wrongdoing. Businesses shouldn’t get caught out by this: presumed abuse without benefiting from the fiscal relief of a lower tax bill is a lose-lose for shareholders.

Don’t let a poor comms strategy undermine a sound fiscal approach. If your approach is justifiable, then justify it. Transparency cannot be a virtue if it is not pursued proactively.

How can we help?

Get in touch with our team

Crisis and litigation

Infinite Global advises a wide range of domestic and international clients facing difficult scenarios in which reputational, legal and commercial risk is high. We advise organizations and individuals, providing counsel and tactical support to mitigate risk and protect reputations when it matters most.

Read More

Accounting

Most accounting firms don’t get credit for the real value they bring to their clients: broad spectrum business advice. At Infinite Global, we understand that accounting firms are not just accountants.

Read More

Wealth and asset management

High net worth clients require a nuanced understanding of their situations and expectations. Their unique legal, structural and practical considerations require subtle and interdisciplinary service. Estate planning, for example, can be closely tied to tax considerations, real estate and financial services — even M&A.

Read More