Insolvency in the headlines: media lessons from the year the ‘dam burst’

February 1, 2023

The annual UK insolvency statistics for 2022 make for stark reading. It was the year the ‘dam burst’ according to R3, the insolvency practitioners trade body, following predictions of a post-covid tsunami – and it was reflected in the headlines.

They’re not wrong. Here are the facts:

- 22,109: The highest level of company insolvencies since 2009

- 18,822: The highest annual number of Creditors’ Voluntary Liquidations (CVLs) since the statistical series began in 1960

- 49.5/1000: The highest company liquidation rate since Q3 2015

It is interesting to consider this data in the context of separate ONS information which has shown a consistent fall in business births since 2015, with births in 2020 at their lowest since 2012.

In addition, it is worth noting that while overall company insolvencies have increased, administrations are broadly comparable to previous years. In fact they were lower than most.

This fact is critically important to bear in mind when seeking to understand how the media reports on an insolvency.

Comparing administrations and CVLs

Administrations and CVLs are often confused, but the difference can be explained fairly simply.

A CVL means that a business has reached the end of the road. It can no longer afford to service its debts. It is closed, and any assets immediately sold (liquidated) to provide returns to creditors.

An administration, however, generally is entered into where there is hope that a business turnaround can be effected – through a restructuring, sale or other mechanism. An administration may result in a liquidation if the business cannot be ‘saved’ or if the underlying company is liquidated following the realisation of assets.

We might, then, conclude that the flatlining of administrations combined with a rise in CVLs demonstrates that more directors are concluding that their businesses cannot be salvaged.

Insolvency in the press

Even before the most recent set of insolvency figures, company failures were high on the agenda for the press.

Several notable brands have ‘gone bust’, for a variety of reasons, generating substantial amounts of media coverage and stakeholder scrutiny (and circumspection).

Paperchase collapsed, with a sale of the brand and Intellectual Property to Tesco on the cards (no pun intended…).

Flybe went under, again, providing more ammunition for those detractors who habitually name it ‘FlyMayBe’.

And lastly, but certainly not least, BritishVolt – now the subject of a potential bid from its original founder. In the first 24 hours or so of the news breaking, there had been more than 700 online media hits for the BritishVolt collapse.

It is interesting that these were the examples referenced by many commentators on the annual company insolvency figures. Paperchase, Flybe and Britishvolt are all administrations.

In fact, reporting on administrations made up around 70% of all press coverage of company insolvencies in 2022.

Yet administrations are only around 5% of total company insolvencies. And it is CVLs which have been rocketing upwards, with most of these likely to be small businesses.

Individually, they aren’t likely to grab the attention of busy news rooms – but aggregate their plight and you have a media story, as we have seen this week

Bodies such as the Federation of Small Business play an important role here in championing the collective, and shining the spotlight on the very real issues at play (recent FSB survey data showed small business optimism plummeted last year).

Media trends

There are important lessons here regarding how insolvencies play out in the press, which is at the heart of why, more often than not, it is administrations which draw the attention of journalists.

Looking over reporting on administrations in 2022, a few points are notable.

Research methodology

Infinite Global has developed a methodology for tracking media reporting of administrations based on our understanding of journalistic trends, built up from advising on over 130 corporate insolvencies. This includes analysing the frequency of use of the key 'stock' phrases used most often by reporters covering administrations. This includes "calls in administrators", "appoints joint administrators" and "collapses into administration". All media data has been gathered using the Next Gen Cision media intelligence platform.

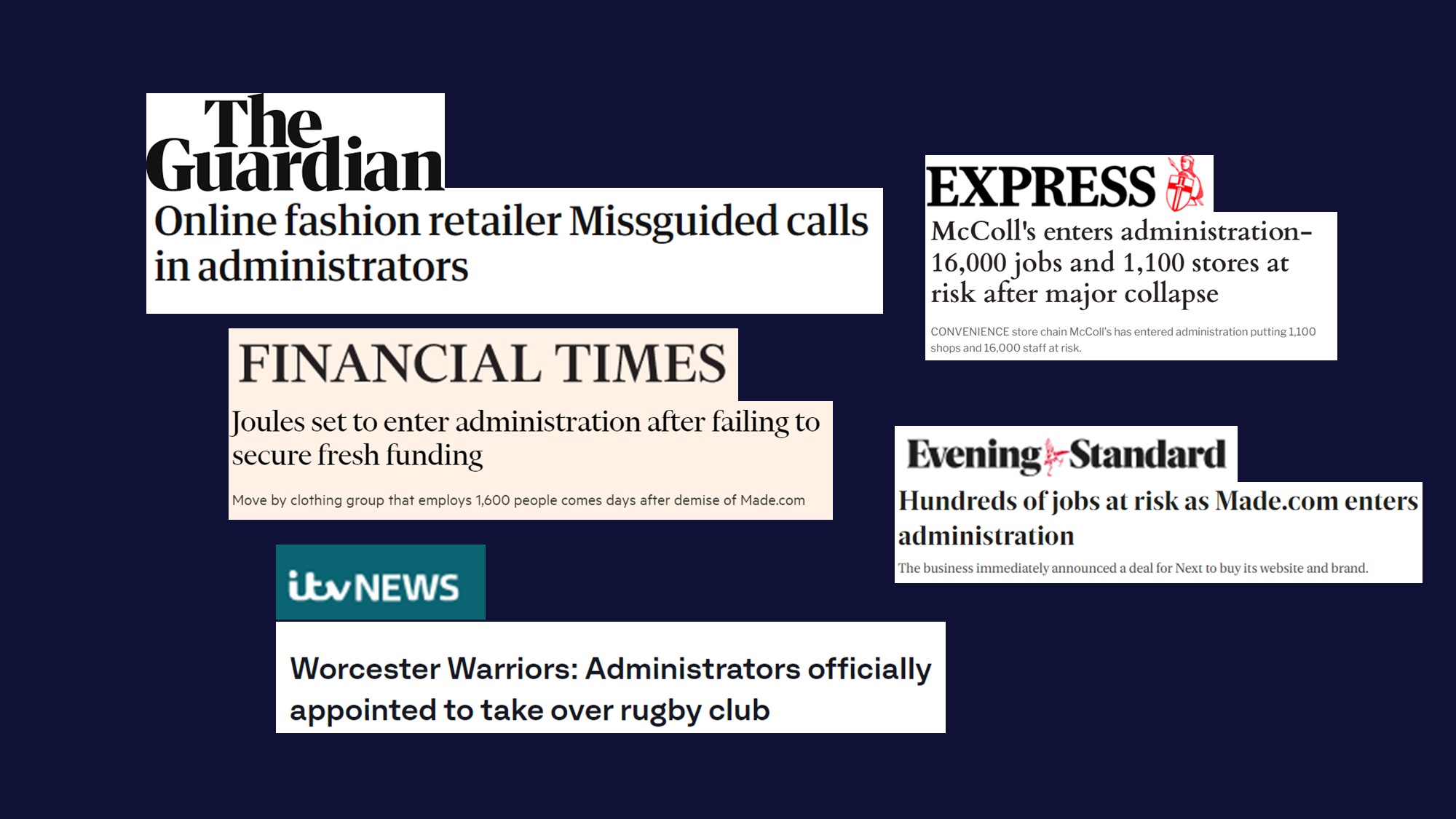

There were three clear spikes in media coverage across the year. Broadly these correspond to:

- May: Missguided and McColls

- September: Worcester Warriors

- November: Joules and Made.com

With administrations usually aiming at a turnaround the reality is that they are more likely to be used by bigger companies with resilient brands from which future value can be derived. They will also have more prospective levers to pull to streamline and gain efficiencies.

Those same companies are also much more likely to have larger workforces whose jobs will be put at risk should the administration result in redundancies or an eventual sale, as well as large customer bases who may feel the effects of disruption.

In the case of Worcester Warriors, such brands may also have wide cultural relevance in their communities.

All of these factors make the individual companies and their ‘financial distress’ (in the common insolvency parlance), highly newsworthy.

These examples correspond to Infinite Global’s Reputation in Restructuring Framework which maps five key factors that drive media coverage of an insolvency.

- Narrative: The story of the business to date, including previous media exposure and public awareness of the brand

- Personality: Any involvement of a high profile individual, such as a politician or celebrity, or a particularly vocal (or infamous) CEO

- Locality: The role and impact of the business in its local community

- Context: Whether the business, and its failure, plays into a wider contextual story – such as market disruption or political turbulence

- Scale: How widespread will the impact of the business failure be? Large numbers of prospective job losses, or large customer bases left out of pocket, will always make headlines

Where an administration, or indeed any insolvency process, has one or more of these ingredients, insolvency practitioners will need to prepare for potential media scrutiny.

The obligation to communicate

Indeed communications more broadly is an incredibly important consideration in an insolvency, and especially so in an administration scenario.

Where a business sale or turnaround is the intended outcome then brand value must be preserved: effective communications is vital to achieving this.

But for insolvency practitioners the need to communicate goes deeper, and further. Certain forms of communication are a legal obligation within the insolvency process (including public listing of any appointment), while practitioners have a fiduciary duty once they have taken control of a company to manage stakeholders effectively. This includes employees and customers, as well as other connected parties.

Throughout, there is a balance to be struck between due empathy, legal requirement, and maintaining clarity over the end goal of the process which is, generally speaking, delivering returns to creditors.

At the same time, insolvency practitioners have their own reputation to look out for.

With, as it seems, many of them about to become very busy indeed, being able to demonstrate an effective grasp of a challenging media landscape is of growing importance.

How can we help?

Email insolvency@infiniteglobal.com to get in touch