Rising company insolvencies reinforce comms obligation for practitioners

November 1, 2023

New figures from the UK Insolvency Service paint a stark picture.

Company insolvencies have reached their highest level since 2009, driven by a combination of the removal of COVID-19 business support and a challenging economic environment not least including rising interest rates and energy bills. Recent research from the Federation of Small Businesses shows that firms have seen a 424% rise in gas costs and 349% increase in electricity since February 2021, for example.

This just isn’t sustainable for many.

Reflecting this, the rising volumes of insolvencies are largely due to large number of Creditors’ Voluntary Liquidations signifying, as the insolvency trade body R3 put it, that many directors have “simply had enough”.

Media reporting on insolvencies

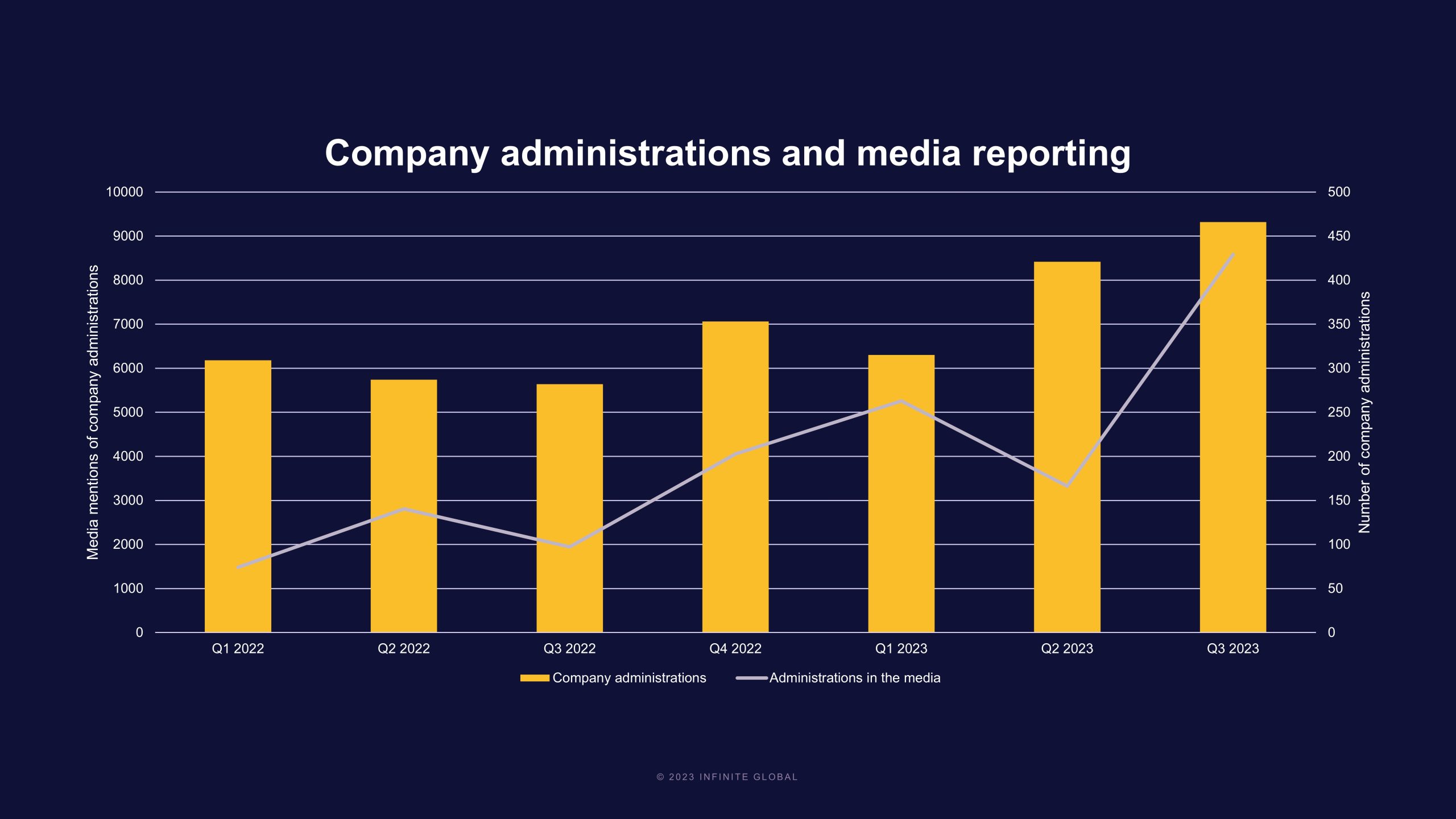

The surge in company insolvencies has also seen high levels of media reporting relating to insolvencies.

The first three quarters of 2023 saw a 67% increase in media stories mentioning insolvencies compared to the whole of 2022. Compared to the same time frame in 2022, the increase was more than 170%.

Yet, for the most part, it remains company administrations specifically which rank most highly on the media agenda.

Indeed, company administrations account for around 72% of all media reporting relating to insolvencies. This is despite administrations forming only around 7% of actual company insolvencies, according to the latest figures.

Read more here to find out why administrations tend to figure more highly than other types of insolvency on the media agenda.

Wilko collapse

There have been a number of business failures so far this year which have attracted media attention, factoring high on Infinite Global’s ‘Reputation in Restructuring’ framework.

Construction firm Buckingham Group, for example, entered administration in September with industry press focusing on the sad prospect of hundreds of job losses (#scale). But this was amplified still further by the fact that the company was the main contractor working with Liverpool Football Club on the expansion of Anfield (#narrative).

But one administration in particular has dominated insolvency headlines so far in 2023. Wilko.

Reputation in Restructuring Framework

1. Narrative: The story of the business to date, including previous media exposure and public awareness of the brand

2. Personality: Any involvement of a high profile individual, such as a politician or celebrity, or a particularly vocal (or infamous) CEO

3. Locality: The role and impact of the business in its local community

4. Context: Whether the business, and its failure, plays into a wider contextual story – such as market disruption or political turbulence

5. Scale: How widespread will the impact of the business failure be? Large numbers of prospective job losses, or large customer bases left out of pocket, will always make headlines

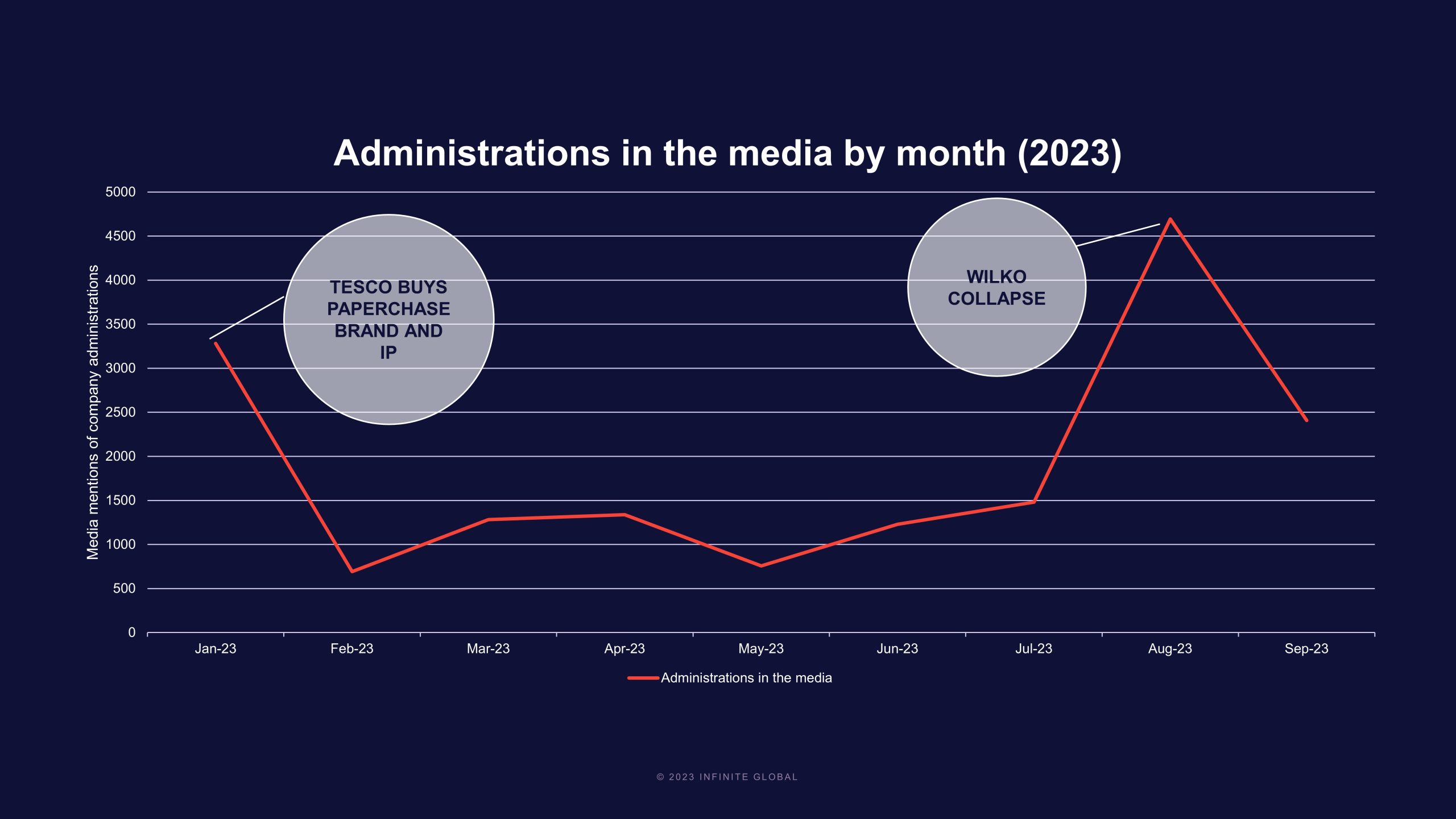

Administrators were appointed to the retailer on the 10th of August, which saw media coverage of insolvencies more than double in Q3 compared to Q2. The previous high point had been in Q1, centring on Tesco’s deal to purchase the brand and IP of Paperchase (as reported by The Guardian here).

Between the start of August and the end of September, there were almost 6,000 mentions of Wilko in media reporting on insolvencies (across all UK online outlets) – accounting for more than 50% of all reporting by itself.

The major players

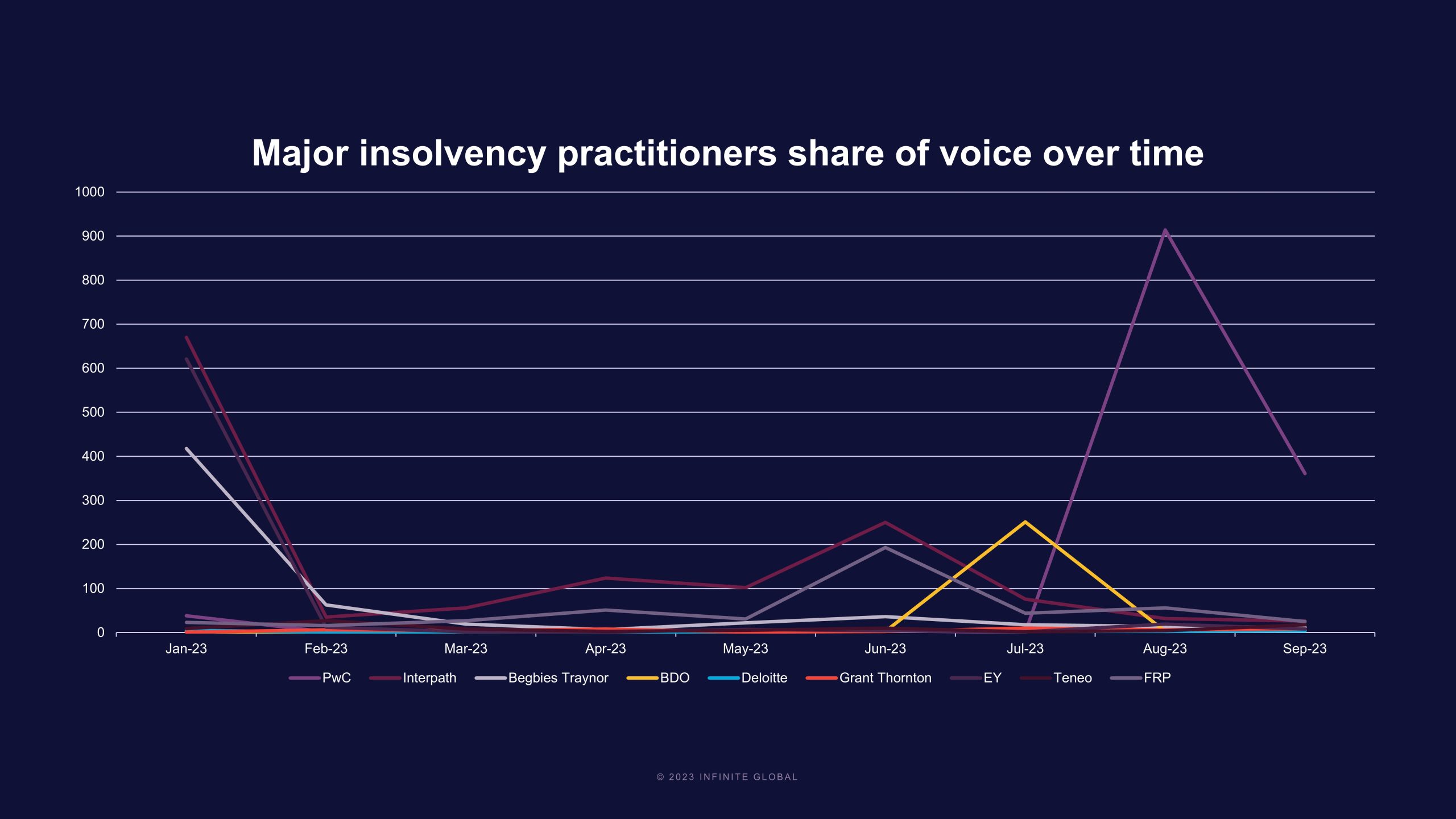

The Wilko collapse also saw a surge in the visibility of administrators PWC. The firm’s ‘share of voice’ in the press in relation to insolvencies grew from just 2% at the end of H1 2023, to 27% by the end of Q3, second only to Interpath across the year in total.

Interpath itself has consistently been the highest profile insolvency practitioner overall in 2023, with high volumes of media reporting in relation to its appointments, with its most visible quarter coming in Q1 in relation to the collapse of Flybe (for the second time). EY ran it a close second in Q1, following its appointment to Britishvolt.

Prior to the Wilko administration, the only month in which Interpath was not the most visible practitioner was July 2023 – during which time there high levels of coverage for BDO which oversaw the sale of City AM to THG.

All this serves to reinforce the role of the insolvency practitioner as the ‘public face’ of an administration, which brings with it significant levels of scrutiny and an obligation to communicate – not least in the pursuit of preserving brand value.

A challenging Christmas?

As we head into Q4 there remains hope that the festive season will bolster businesses. But for many it will be make or break.

Often insolvencies are argued to be the sign of economic recovery, the logic being that creditors are more confident in going after debts and so-called ‘zombie’ companies fall by the wayside enabling productivity to rise.

But the shock of interest rate rises and the soaring cost of doing business is likely to tip many viable businesses into financial difficulty. This may see an increase in distressed acquisitions, with established brands with strong goodwill given a new lease of life (Missguided, Paperchase and others).

In any case, particularly in the run up to Christmas when stories of job losses will be even more emotionally charged than usual, and amid significant public and press scrutiny of the government (and Bank of England’s) position on business and the economy with an election looming, effective communications will continue to factor high on the list of priorities for insolvency practitioners and brands undertaking an insolvency or restructuring process.

How can we help?

Email insolvency@infiniteglobal.com to get in touch