The age of the CVA: Insolvencies in the media

July 1, 2019 • 6 minute read

As we look back on the last financial year, it’s safe to say that it was a year of continued disruption and convergence in the property industry, but perhaps most notably on the high street.

Nothing characterises this better than the seemingly endless stream of Company Voluntary Arrangements – CVAs – dominating the headlines.

This form of restructuring strategy enables a company to ring fence its debt and agree a repayment schedule with creditors – very often banks, but also landlords and suppliers – which is more preferable and provides the company a chance to keep the business on its feet. Many creditors are, understandably, keener to pursue this as an option rather than have a company collapse into administration, which may lead to an even more diminished proportion of debt being repaid.

There is an alternative view however, and one that has gained significant air-time following the rise in popularity of CVAs in the retail industry. That is, CVAs run the risk of: a) propping up retailers that should, given market forces, have failed and thereby have a negative knock-on effect for landlord creditors and their investors (including in many cases pension funds), and b) creating an artificial economy whereby those retailers who are not failing, and have evolved with the times, are essentially penalised when they end up competing against other retailers who have had their rents reduced.

Arguably the situation we find ourselves in now in the retail industry is a microcosm of that which characterised a large component of the broader economy following the financial crash, in particular the growth of so-called ‘zombie companies’. These companies, basically, were those which in any normal economic situation would have failed but, because creditors were unwilling to claim old debt and topple businesses, kept hanging on. This, it has been argued, was at least partly a cause of the productivity issues faced by the UK and Europe more widely.

Clearly not all retailers are failing and one could make the case that those who are no longer best-serving the needs of shoppers – their raison d’être – should be investing rapidly to evolve or should be allowed to wind up in favour of other operators, allowing a redistribution of talent and a re-assignment of real estate for alternative uses (notably residential, experience/leisure or community-based purposes). Of course, the practicalities are much more complex than that, given the emotional as well as economic challenges.

The media perspective

The broader trend aside, there is a fascinating paradox at play here.

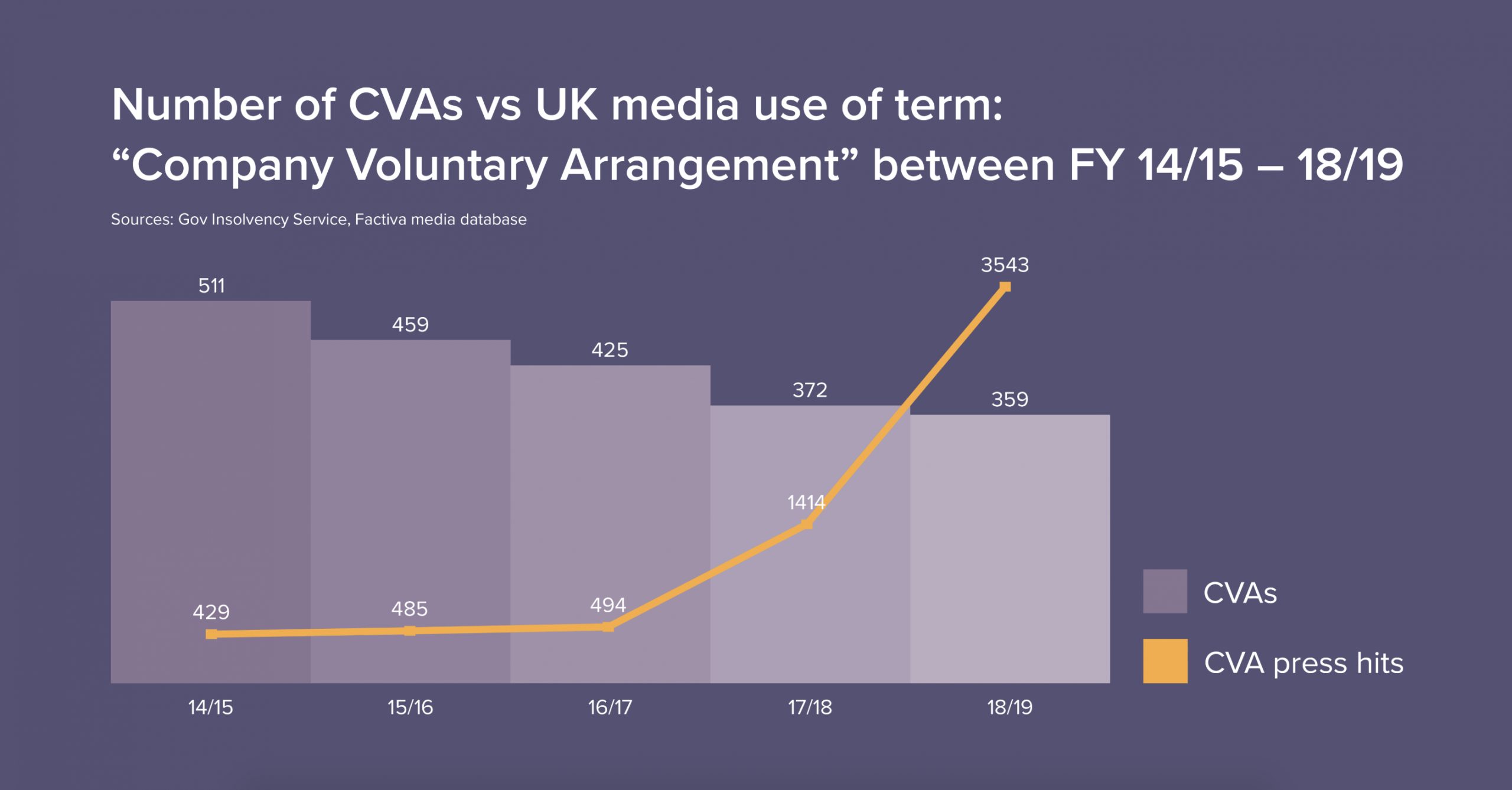

The fact of the matter is that while company insolvencies have been creeping back up from the days of the Zombies, despite what the expectations might be CVAs have actually been on a downward trend for the last five years according to official UK statistics.

As PR advisers, therefore, it is interesting to note that media coverage of CVAs has dramatically increased in the same period.

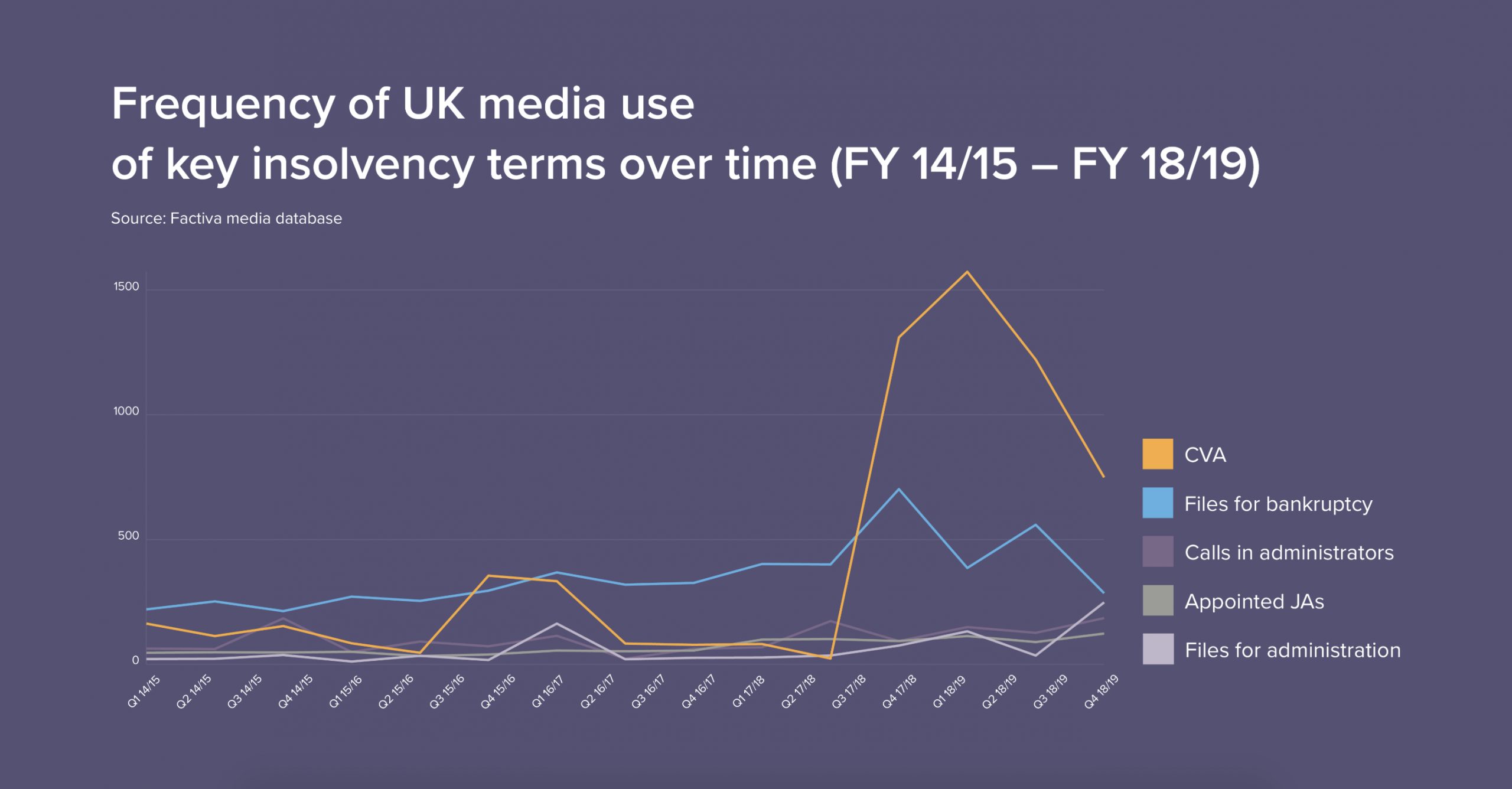

Indeed, CVAs are now by far and away the most frequently used “buzzword” in the insolvency reporting space. Infinite Global’s 2018 report, Call in the Administrators, analysed the media usage of four key terms most usually utilised by reporters covering company insolvency matters:

- “Files for administration”

- “Files for bankruptcy”

- “Appointed joint administrators”

- “Calls in administrators”

When we add the term “Company Voluntary Arrangement” to the research, the spike between H2 2017 and H2 2018 is plain to see, and not at all surprising given how the CVA is now firmly part of the zeitgeist.

There are clear lessons here which build on our 6 core questions for insolvency communications, and which any brand preparing to handle such matters should be cognisant of.

Firstly, CVAs have arrived on the media’s agenda and they are unlikely to go away any time soon. Far from being some arcane piece of technical company law they are now part of common parlance and tangible to the man on the street.

With that in mind, secondly perhaps the reason for the dichotomy between actual CVA volumes and CVA media profile is the scale and recognisability of the companies involved. Put simply – in insolvencies, brand profile matters. Businesses in the retail world are a part of every-day life and are instantly recognisable – they are tangible to media consumers and this makes them easy pray for reporters looking for stories which will resonate with their readers.

Similarly, wherever there is a high-profile individual involved in the drama (cue Philip Green), the media will be even more ravenous. These lessons should be applied and considered by all communicators in insolvency situations.

6 questions for insolvency comms

- Being the biggest or the first in any given market is likely to induce media attention. Are you prepared to answer questions?

- Does the situation play into a wider debate either dominating the company in question’s sector, or linked to its stakeholder groups? If it does, it makes a fuller, meatier story for reporters to get their teeth into.

- Is a celebrity involved? Is one of the creditors, employees or company directors a well-known public figure? Any connection with a headline-grabbing name ratchets up the media’s interest.

- Is there a government / policy angle? This broadly connects with point number two, but if there is a political angle – particularly at a time when government is under increasing scrutiny – then this will fuel the media and public debate.

- Have you remembered the local press? Often a company’s core client base, employees and stakeholders will get information from local news outlets and these are ignored at your peril.

- Have you checked the Gazette? Remember that insolvencies are a matter of public record. They are a court-driven process with details available in the public domain via the London Gazette. They are relatively simple matters for journalists to uncover and explore. Brands and their communicators should therefore always plan ahead and be prepared for media interest, whatever the scale of the business involved in an insolvency proceeding.

All media reporting data in this article has been taken from Dow Jones Factiva, and is correct as of 1 July 2019.

Infinite Global specialises in special situations communications, including working with insolvency advisors and distressed organisations, as well as within the broader property industry. Click here to read more about our services, or get in touch.