New rules, new risks: How reputation strategy has changed in 2020

June 18, 2020 • 5 minute read

The global economy faces unparalleled disruption and uncertainty. As organisations, industries and national governments scramble to understand the new risk landscape that has emerged over the opening six months of 2020, it is clear that business-as-usual is business no more.

Leadership teams have tough decisions to make. On one hand, organisations of all sizes continue to prioritise urgent near-term survival in the face of an ongoing Covid-19 threat and the strictures of lockdown conditions. At the same time, decision makers must keep one eye trained firmly on the horizon, to understand the twists and turns of an unfamiliar road ahead.

In one sense, this is nothing new. Corporate risk management is based upon the careful calculation of threats and opportunities under conditions of uncertainty. However, events in recent months represent something of a quantum leap in terms of how organisations’ risk profile have evolved, not least in relation to reputational risk. The unprecedented shock of Covid-19 and the global lockdown recession, as well as the significant impact of the Black Lives Matter movement and other sources of civil unrest, have left an indelible mark upon the nature of reputation management for individuals and brands in every corner of the economy. In this new reality, new – or significantly adapted – thinking is required.

A new reputational risk landscape

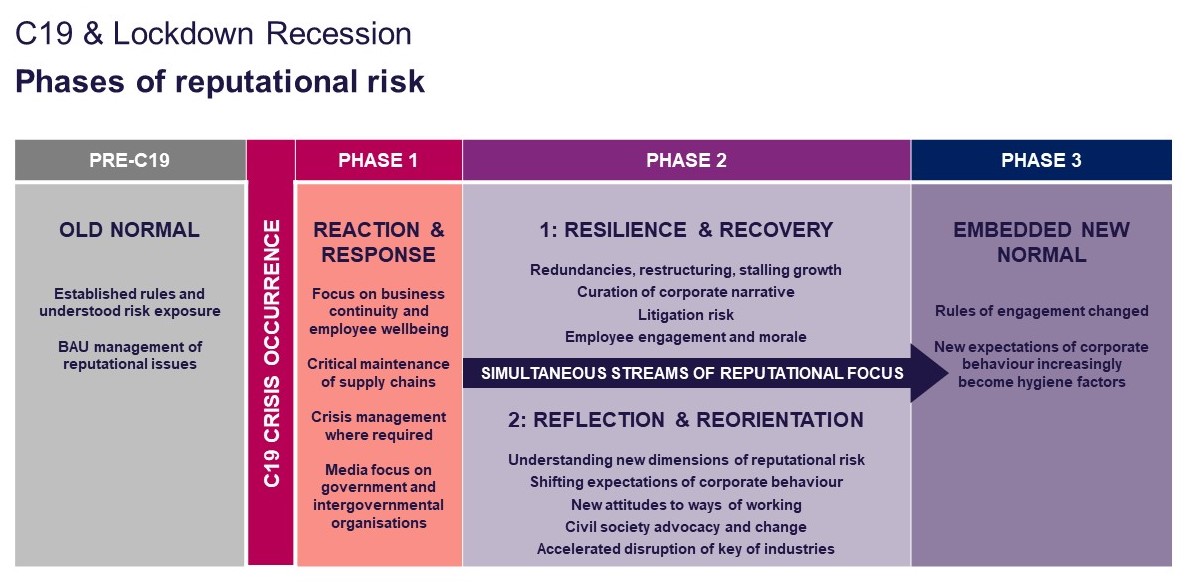

Amidst fluid conditions, situational awareness is everything. Infinite Global has examined the critical reputational issues emerging from Covid-19 and the lockdown recession, to help leadership teams better understand the nature of the risks they face and how key aspects of media and public scrutiny are evolving over time. We identify three distinct phases of strategic focus, commencing with the initiation of lockdown restrictions in March 2020. At the time of writing (June 2020), the UK is experiencing the end of Phase 1 and the beginning of Phase 2. Phase 2 is a critical stage, in which leadership teams must balance two simultaneous fields of concern.

Phase 1: Reaction & Response

Phase 1 saw organisations focus on immediate Reaction & Response, following the sharp escalation of the Covid-19 pandemic. Businesses moved quickly to activate continuity and crisis planning to protect the health and wellbeing of employees, preserve essential value chain systems and sustain business-as-usual operations where possible.

Some leadership teams managed this process more smoothly than others. Decision-making during active crises is fraught with difficulty and few crisis plans long survive the harsh examination of real world conditions. As businesses raced to manage social distancing requirements, furloughed staff, stalling supply and demand and more, the early weeks of Phase 1 provided a jarring reminder of the need for every organisation to undertake rigorous planning around a comprehensive range of risk scenarios. Moreover, it demonstrates the importance of ensuring that the entire infrastructure of an organization’s crisis response – covering incident response plans, business continuity planning, crisis management and communications strategy, leadership decision-making and more – works seamlessly as a collective whole, not as a series of siloed initiatives. Moving forward, the learning opportunity presented by Phase 1 of the Covid-19 experience must not be missed by risk managers. Leadership teams routinely fail to heed the full lessons of crises and too often neglect to take appropriate steps required to mitigate the risk of similar scenarios recurring in future.

“The early weeks of Phase 1 provided a jarring reminder of the need for every organisation to undertake rigorous business continuity and crisis planning around a comprehensive range of risk scenarios.”

Against the backdrop of a pandemic that had befallen the global economy, stakeholder scrutiny was initially benevolent towards companies grappling imperfectly with tough conditions, as media attention instead fixed squarely on governments and intergovernmental organisations’ efforts to tackle the pandemic. In time however, media attitudes began to discernibly shift, marked by intensifying scrutiny of businesses perceived to be mishandling their response to the crisis and, in particular, their treatment of employees and supply chain partners. This trend has continued to sharpen over recent weeks, as the UK economy has transitioned into a second phase of reputational risk, in which organisations are now tasked with balancing two distinct streams of strategic concern.

Phase 2: Dual streams of reputational risk

In this new phase, two distinguishable streams of reputational risk present. Leadership teams must urgently manage the first, while carefully considering the second.

Stream 1: Resilience & Recovery

The first stream of risk concerns businesses’ primary focus now and over coming months: commercial Resilience & Recovery. The bottom line impact of Covid-19 and its resultant recession is already revealing itself to be deep and far-reaching. As in any economic downturn, businesses now face growing reputational risk stemming from tough decisions increasingly being made around stalling revenues, redundancies and restructuring. Leadership teams must think cautiously about how they manage their corporate narrative in a way that minimises reputational risk exposure, not least towards capital markets. This is particularly true in those sectors already battling longer-term difficulties and dipping demand, not least high street retail.

“Businesses now face heightening reputational risk stemming from tough decisions increasingly being made around redundancies, restructuring and stalling growth.”

Litigation risk is now heightening, as contentious employment matters increase in volume, contract disputes emerge and high profile insurance claims are made. As job losses mount, the emotional impact on employee morale and engagement may prove severe, exacerbated potentially by new remote working and longer-term social distancing. Questions may grow over corporate governance and leadership, fuelled in part by an expected rise in whistleblowing. Simultaneously, pre-existing risks remain and intensify as decision-making energies are focused narrowly on short-term business survival, not least the threat of data breach and cyber-attack. All the while, media appetite will remain high for any hint of commercial difficulty, leadership missteps and individual wrongdoing. Infinite Global has recently explored several of these reputational risk issues in greater depth, including the UK’s insolvency landscape, the rise of whistleblowing and the need to tread carefully when using the UK government’s furlough scheme.

Stream 2: Reflection & Reorientation

Such has been the magnitude of Covid-19 and its economic repercussions that a second, distinct stream of strategic concern presents. While tackling the core challenges of ‘Resilience & Recovery’ outlined above, leadership teams must simultaneously engage in Reflection and Reorientation around the extent to which stakeholder expectations of how businesses should operate are now markedly shifting. As stakeholder expectations evolve, so too does the nature of reputational risk. If the opening months of 2020 have changed the reputational rules of the game, then businesses need to adapt their thinking accordingly.

Covid-19 and the lockdown recession have intensified critical questions around the role of private sector business in society and the nature of good corporate citizenship. This debate has only escalated in recent weeks amidst global protests in support of the Black Lives Matter movement. More than ever, corporate decision-making has become inculcated with a moral (and thus reputational) dimension. Companies now seen to be failing in their duty towards employees, supply chain partners and other stakeholders, or acting out of step with prevailing public sentiment around employers’ broader societal responsibilities, should expect significant scrutiny. Media interest is increasingly being drawn towards any evidence of companies seen to be contravening consumers’ sense of right and wrong.

In part, this is not a new phenomenon. The ethical responsibilities that businesses hold towards the communities in which they operate has become in recent years an increasing area of focus for policymakers and regulators, as well as the media and public more widely. This has been reflected in the growing importance of ESG reporting, with investors increasingly urging companies to articulate a sustainable long-term value creation strategy that combines commercial growth with careful management of obligations beyond the balance sheet. It is now nine years since Michael Porter and Mark Kramer published their seminal 2011 article in the Harvard Business Review, calling on businesses to further the cause of stakeholder capitalism through the creation of ‘shared value’ by expanding their markets in ways that benefit society and shareholders simultaneously.

“Now more than ever, a moral compass should be regarded as an essential tool in corporate decision-making.”

However, the shared experience of 2020 has seen the ethical imperative for businesses to do right, and be seen to be doing right, intensify still further. This raises clear implications for the role that organisational values and purpose play in guiding corporate behaviour. Now more than ever, a moral compass should be regarded as an essential tool in corporate decision-making.

How can we help?

Get in touch with our team